Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Buying a Fixer-Upper

For some homebuyers, a fixer-upper is their idea of a dream home. However, the process of buying a fixer-upper comes with additional responsibilities compared to properties in better condition or new construction homes. Preparing for the process comes down to creating a remodeling plan, knowing what to look for when searching for listings, and understanding what financing options are available.

Planning for a Fixer-Upper

Fixer-uppers require a future-oriented mindset. Knowing the magnitude of the projects you and your household are willing to take on will help to form your budget and your expectations as time goes on. With some basic cost analysis for any given project, you’ll have to decide whether it’s worth it to buy the materials yourself and do it DIY or hire a professional. When testing the waters for professional remodeling, get specific quotes so you can compare costs between contractors. Understand that in addition to the down payment and closing fees, the costs involved in a fixer-upper purchase have the potential to go over-budget easily. Familiarize yourself with permitting in your area to understand how to navigate any legal roadblocks in the renovation process and to better assess your timeline for your home improvement projects.

Searching For a Fixer-Upper

- Location: Whether you are purchasing a fixer-upper with plans to sell it, rent it out, or live in it, consider its location before purchasing. If you’re planning on selling or renting, location is one of the most important factors in making a return on your investment. And if you’re planning to live in your fixer-upper, keep in mind that location will be a large part of your experience in the home. If you’re looking to sell eventually, talk to your agent to identify high ROI remodeling projects that will pique buyer interest in your area.

- Scope of Renovation: If you are looking for a smaller scale renovation, look for listings that require cosmetic projects like new interior and exterior paint, fresh carpeting and flooring, appliance upgrades, and basic landscaping maintenance. More expensive and involved projects include re-roofing, replacing plumbing and sewer lines, replacing HVAC systems, and full-scale room remodels.

- Inspections: Beyond a standard home inspection, which covers components of the home like its plumbing and foundation, consider specialized inspections for pests, roof certifications, and engineering reports. This will help differentiate between the property’s minor flaws and critical problems, further informing your decision when it comes time to prepare an offer.

Financing Options

You’ll be looking at different types of mortgages when buying a fixer-upper, but keep in mind that renovation loans specifically allow buyers to finance the home and the improvements to the property together. Extra consultations, inspections, and appraisals are often required in the loan process, but they help guide the work and resulting home value. Talk with your lender about which option is best for you.

- FHA 203(k): The Federal Housing Administration’s (FHA) 203(k) loans can be used for most projects in the process of fixing up a home. In comparison to conventional mortgages, they may accept lower incomes and credit scores for qualified borrowers.

- VA renovation loan: With this loan, the home improvement costs are combined into the loan amount for the home purchase. Contractors employed in any renovations must be VA-approved and appraisers involved in the appraisal process must be VA-certified.

- HomeStyle Loan – Fannie Mae: The HomeStyle Renovation Loan can be used by buyers purchasing a fixer-upper, or by homeowners refinancing their homes to cover the improvements. This loan also allows for luxury projects, such as pools and landscaping.

- CHOICERenovation Loan – Freddie Mac: This renovation mortgage is guaranteed through Freddie Mac, allowing projects that bolster a home’s ability to withstand natural disasters or repair damage caused by a past disaster.

If you’re interested in buying a fixer-upper, connect with me – I can help you understand the process and to discuss what makes the most sense for you.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

This article originally appeared on the Windermere Blog, written by: Sandy Dodge.

2024 Buyer Agency Law Changes: What Every Buyer Should Know

Maybe you’ve heard about the class action lawsuits in other states, or maybe you’ve clicked a link discussing how REALTORs® conspired to artificially inflate home prices through price fixing of commissions. What you probably haven’t seen is that in Washington our REALTORs® and our NWMLS have been actively working to make the real estate marketplace more transparent and consumer friendly since 2019. Through our requests of the legislature Real Estate Agency Law is changing on January 1, 2024. It will significantly affect how you, the consumer, engage a real estate broker among other things. If you’re thinking about buying a home in the Seattle area ever again, read this.

Washington was among the first states in the country to adopt buyer agency in the late 90’s. Before this ground-breaking consumer protection, all agents were considered agents of the seller; if a buyer was working with a real estate professional, that person wasn’t a “buyer’s broker” but rather a “sub-agent” for the seller. Under current law, all agents are agents for the buyer unless there’s an agreement to the contrary. An agency relationship is created the moment you ask, “how is the market?” or an agent hands you a business card. That means that almost immediately as a home buyer you have protections afforded to you by the law of our state. An agent only becomes an agent for the seller through written agreement.

Somewhere along the way (and there are lots of possible explanations for this, practical rather than nefarious), written agreements between buyers and their brokers were deemed unimportant. Very few practitioners have these agreements signed by their clients, even though they are encouraged to do so. The law automatically protects both parties and the seller sets the compensation, so it was a pretty natural path: focus on the other 1,000 things you need to educate the consumer on instead of discussing such gauche topics as how we generate revenue as business people. AKA: how we feed our families. AKA: what does buying a home truly cost.

The law is being updated to become even more consumer friendly and that means an important change: If you are a home buyer shopping for a home you must sign a “brokerage services agreement” with your broker after January 1, 2024. This agreement must discuss the fee that your broker will charge and where that money will come from. It’s a wonderfully positive change that we as Washington REALTORs® lobbied for in Olympia in January 2023 (our owner, Rachel Mehmedagic, was there!). REALTORs® asked for more regulation on themselves. This will take us to a higher level of professionalism, bring it on! If your broker doesn’t ask you to sign an agreement, they are not up to date on what is going on in their industry. Start shopping for a new broker.

The NWMLS has created a form for all members to use, but that is not the only form that you may be presented with. Be careful to read what you’re signing. Ask questions. Be a diligent consumer. Demand professionalism from your broker. We will rise to the occasion, we’re confident of this.

For more on what the NWMLS has done to stay ahead of the national conversation: https://www.nwmls.com/northwest-mlss-members-provide-buyers-and-sellers-with-choices-control-and-complete-transparency/. This is not the only change to Agency Law, just the one piece of what we wanted to discuss today. To read the new law: https://app.leg.wa.gov/rcw/default.aspx?cite=18.86 or see the line-item changes here.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

© Copyright 2023, Windermere Real Estate/Mercer Island.

Buying a Home: A Start-to-Finish Guide

You want to buy a home.

Where do you begin?

When you’re ready to buy—or maybe just ready to start seriously thinking about it—there’s a lot you can do to prepare. Here is a checklist to help you get started…

1. Determine a Price Range

Step one is finding out your budget for your new home. The best way to do that is to meet with a mortgage professional who will review your income, assets, and credit history in order to pre-approve you for a loan. Not only does getting pre-approved allow you to narrow your home search, but it also makes your offer stronger when it comes time buy. If you don’t currently have a mortgage professional, I would be happy to recommend one.

You can also use my Home Monthly Payment Calculator to experiment with different principal amounts, interest rates, down payments, taxes, and insurance to get an idea of what you can afford. Keep in mind that these calculations are meant to be estimates—interest rates change weekly and will be determined by your credit score.

2. Make a Wish List

Imagine your ideal home. How many beds/baths does it have? How big is the backyard? How close is it to the local park? Use our Wish List to guide you in your search online and with me.

3. Start Your Searching

Once you know how much you can afford and what you’re looking for in a home, it’s time to start your search. My online search tool makes it easy to search for homes, keep track of your favorites and subscribe to property alerts when a fitting listing hits the market in your area. I can also send you potential homes and take you to tour them in person once you’re ready to get serious.

4. Know What to Avoid

As you prepare to buy, knowing what not to do can often be just as helpful as knowing what to do. By understanding the pitfalls buyers can fall into, you can identify the signs of these common buying mistakes ahead of time. Check out this article on buying homes that have been flipped, too.

You’ve found the home.

What now?

Once you’ve found the home you can see yourself living in, what’s next? There are many steps to go through before you can officially call yourself a homeowner. I will guide you through this process, but in the meantime, here’s a preview of what you can expect.

1. Negotiation

When making an offer on a home, I will negotiate on your behalf in order to attain the best terms for you. This can include negotiating the price, repair costs, timelines, and contingencies.

2. Purchase & Sale Agreement (Contract)

This is the legal contract you and the seller will enter into once your offer has been accepted by the seller. It outlines the terms and conditions of the sale and is signed by both parties.

3. Inspection

Once the Purchase and Sale Agreement is signed, a home inspector is hired to examine the home’s health, safety, and major mechanical systems. If any issues arise from an inspection, you may be able to renegotiate.

In a competitive offer situation where you wish to waive your inspection contingency in order to make your offer more appealing, I may advise you to conduct a “pre-inspection”—that is, an inspection that is conducted before you put an offer in on the house.

4. Financing

After your offer is accepted, the next step is to get final loan approval. During this process the lender will decide if they’re willing to approve your mortgage based on things like your creditworthiness and the title history and appraisal of the home you want to buy.

5. Title Report

This is a report for you and your lender detailing the history of the home you’re buying to ensure there are no legal barriers to purchasing it.

6. Escrow

Escrow is an impartial third-party process in which documents and funds are deposited by buyers, sellers, and lenders to facilitate the closing of a transaction. To learn more, read this short guide to understanding escrow.

7. Closing

During this final step of the home buying process, ownership is transferred from the seller to the buyer, closing costs are paid, and several legal documents are prepared and signed, all leading to the closing date. After closing is finalized and recorded and the funds are disbursed, the home is yours!

8. Moving Day!

Check out my printable Moving Checklist as you get ready for the big day.

© Copyright 2023, Windermere Real Estate/Mercer Island.

What is an Adjustable-Rate Mortgage (ARM)?

Securing the most advantageous financing for your situation is an integral part of the success formula of buying a home. After getting pre-approved but once you’ve found the home you’d like to pursue, one of your primary tasks is exploring different loan products to see which best fits your situation. This is the fork in the road where you’ll need to decide between a fixed-rate mortgage and an adjustable-rate mortgage (ARM). The following information will help you gain a better understanding of ARMs to help you decide whether they’re right for you.

What Is an Adjustable-Rate Mortgage (ARM)?

After your down payment, your mortgage will finance the remainder of your home purchase. Whereas fixed-rate mortgages allow you to lock in a specific interest rate and payment for the life of your loan, adjustable-rate mortgages’ interest rates will fluctuate over time, thus changing your loan payment. It’s typical for ARMs to begin with a low introductory interest rate, but once that first stage of the loan has passed, they will begin to shift up and down. ARMs generally have a cap that specifies the maximum rate that can occur for that loan.

Let’s say you secure an adjustable-rate mortgage with 30-year terms, the first five of which are at a fixed rate. When the variable interest portion of the loan kicks in, your mortgage’s fluctuations will be measured against an index. If the index is higher than when you secured the loan, your rate and loan payment will go up—and vice versa. How often your ARM rates change depends on your agreement with your lender. Talk to your mortgage broker to learn more about the characteristics of adjustable-rate mortgages.

Pros and Cons of an Adjustable-Rate Mortgage (ARM)

| Pros | Cons |

|

|

|

|

|

|

|

Different Types of Adjustable-Rate Mortgages (ARMs)

Hybrid ARM: As outlined above, a hybrid ARM begins with a fixed-rate introductory period followed by an adjustable-rate period. Typically, a hybrid ARM’s fixed-rate period lasts anywhere between three to 10 years, and its rates adjust at an agreed-upon frequency during the adjustable-rate period, such as once every six months or once a year.

Interest-Only ARM: With an interest-only ARM, you pay just the interest on the loan for a specified introductory period, then the principal payments kick in on top. The longer the introductory period, the higher your payments will be when the delayed principal payments enter the equation.

Payment-Option ARM: Not all states allow these loan products because they can get home buyers into hot water quickly if rates increase. They include flexibility to choose your monthly payments with a payment-option ARM, including interest-only payments and minimum payments that don’t cover interest.

Home Monthly Payment Calculator

To get an idea of how your mortgage payment will fit into your budget, use our free Home Monthly Payment Calculator by clicking the button below. With current rates based on national averages and customizable mortgage terms, you can experiment with different values to get an estimate of your monthly payment for any listing price.

Adapted from an article that originally appeared on the Windermere blog September 28, 2022. Written by: Sandy Dodge.

© Copyright 2022, Windermere Real Estate/Mercer Island.

How to Avoid Overpaying for a Home in a Transitioning Market

Look Carefully at the Home Itself

Here are four home attributes beyond the number of bedrooms and baths that you should have your eye on…

Home (building) quality: Very well-built homes are a rare find and typically worth every penny of their price. Don’t confuse them with so-so homes that just measure up to the city inspector’s threshold. Lesser quality homes will cost you more in upkeep and replacement as systems and components wear out. If you purchase a lesser quality home for less, the differential might just cover the added maintenance expense. But, if you purchase a fair quality home at the going rate of higher quality homes, you might likely be overpaying.

Deferred maintenance: Different than home quality, deferred maintenance includes the to-do list of items that need to be done to maintain a home’s integrity. A home that has been well maintained over its life typically is a better investment than one that hasn’t. The true cost of deferred maintenance often adds up to more than the cost of the repairs themselves. Don’t forget to factor in the reduced life span of other components—like replacement of damaged wood beneath peeling paint or mold remediation in a damp basement caused by a clogged foundation drain.

Setting: The saying “location, location, location” didn’t get its fame from out of nowhere. A home with an ideal setting on its lot and in the neighborhood—away from busy roads and utility poles/boxes, with adequate privacy, good topography, best positioned to capture views if available, and not adjacent to undesirable elements (poorly maintained homes, water towers or other unsightly public structures, high traffic facilities, etc.) will have more value than a less-ideally sited home. When deciding what to pay for a property it is critical that you evaluate these aspects and any others relevant to a specific neighborhood to determine the +/- effect on value.

Floor plan: How a home lives—flow from room to room, size of rooms, open/closed-off spaces, and below ground vs. above ground living are every bit as important as the total home square footage. You can change a lot of things about a home, but it is very difficult to change a bad floor plan. When you are deciding how high to make that multiple offer bid, consider factoring in the added value or take-away of the floor plan.

Beyond the Four Walls

Interest Rates: In addition to being more selective about the home itself, it pays off to understand how interest rates impact your monthly housing cost. It’s a bigger deal than you might think. Every 1% increase in interest rate equates to roughly a 10% decrease in buying power. Said differently, a 10% drop in home sale price would be wiped out by a subtle 1% increase in mortgage interest rate. This means you can obtain a much more expensive home when rates are low, whereas higher rates get you less home—even though you still pay the same monthly payment.

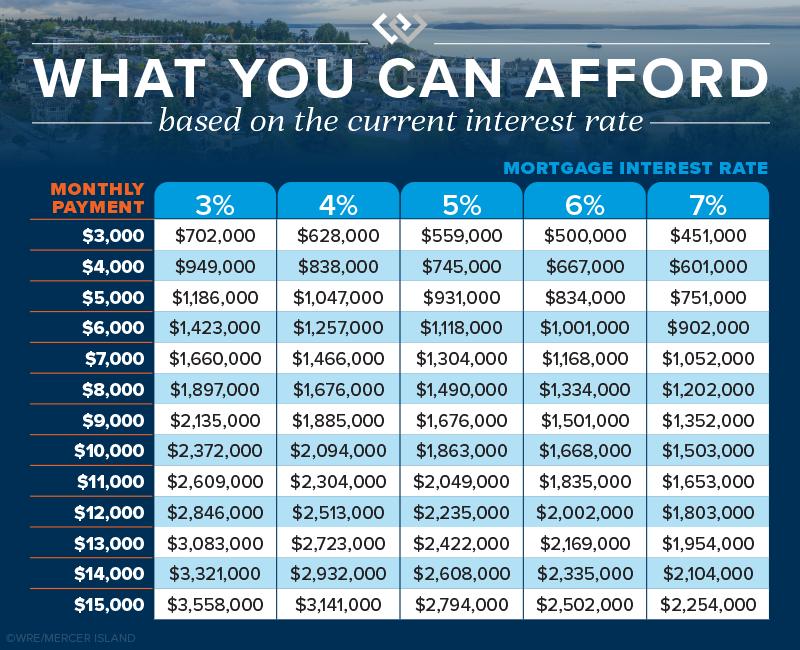

If you have $5,000 a month to budget for a house payment (before taxes and insurance), you could purchase a $931,000 house at a 5% mortgage rate. If rates went up to 6%, the same monthly payment would only get you an $834,000 home. Your buying power diminishes considerably with each bump up in rates.

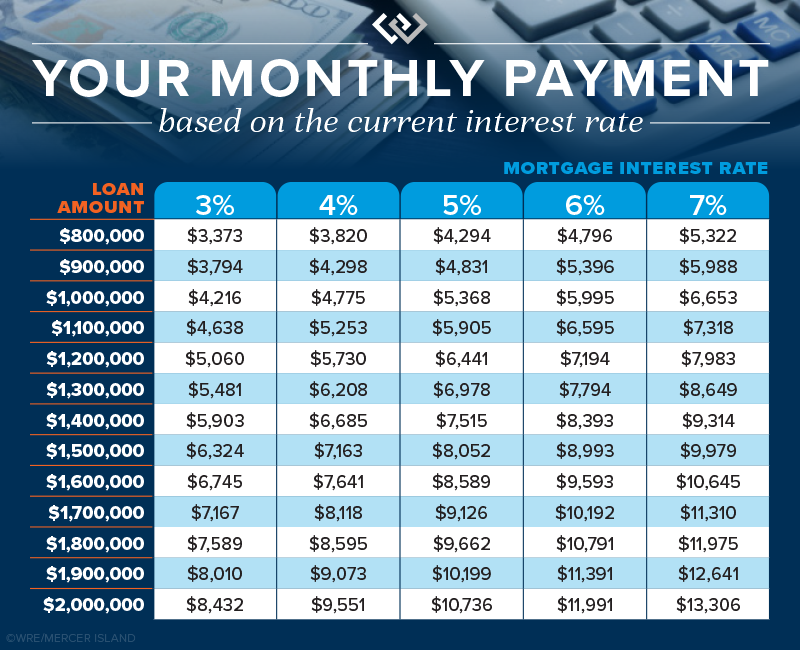

This second chart below shows how interest rates impact monthly payments. If you’re purchasing a $950,000 house at a 5% interest rate, you’ll be paying $596 less every month than if rates were 6%. That adds up quick…$7,152 in one year alone!

Job and Location Stability: Like nearly any investment vehicle, being able to buy and sell on your own time allows you take advantage of ideal market conditions or hold until a more favorable market returns. In an uncertain market, you should plan to be able to stay put for a minimum of 5-7 years if needed. If relocation or job loss is a distinct possibility, waiting to buy might avoid loss as a result of an untimely sale.

Homeownership Lifestyle: For many, homeownership represents a life accomplishment, independence, and financial security. For others, one more thing requiring maintenance and upkeep. Knowing where you stand (at this moment in time anyway) when it comes to evaluating the pros and cons of homeownership as a lifestyle choice is a better first step than an afterthought.

Final Thoughts

Want to know how you can best protect yourself in a changing real estate market? Reach out to us for help evaluating whether it would make financial sense to buy now or wait.

We earn the trust and loyalty of our brokers and clients by doing real estate exceptionally well. The leader in our market, we deliver client-focused service in an authentic, collaborative, and transparent manner and with the unmatched knowledge and expertise that comes from decades of experience.

2737 77th Ave SE, Mercer Island, WA 98040 | (206) 232-0446

mercerisland@windermere.com

© Copyright 2022, Windermere Real Estate/Mercer Island.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link